I’ve been a driver for ride-hailing services since 2016, and between Lyft and Uber, I’ve racked up nearly 10,000 rides. I’ve put more than 150,000 miles on my Chevy Sonic, driving something like 40 hours a week.

Too many people see the “earn $30+ an hour!” ads that Lyft and Uber buy in their area and get seduced. They don’t know what they’re in for. There is precious little information out there on what the real deal is. Unless you’ve done it, it can be hard to understand what driving for these operations is really like.

But, I’ll tell you.

What is the pay like?

I’ve been driving since March of 2016, and over that time, both Uber and Lyft’s pay structure has become more opaque. When I originally started, I made decent money - enough to comfortably live while finishing my undergrad degree. But over the years I’ve been driving, I’ve watched my weekly payouts shrink, and I’ve had to drive more, to make less money.

Last year, after taxes and expenses, it turns out that I technically paid to drive for Lyft and Uber.

When I initially joined in early 2016, pay for drivers was pretty straightforward - via a percentage-based commission. I was told that in my market of Columbus, Ohio, Lyft took a commission of 25 percent and Uber took 28 percent of whatever the passenger paid, pre-tip. In fact, some passengers, internet denizens, and even some drivers I’ve chatted with think driver pay is still entirely commission-based.

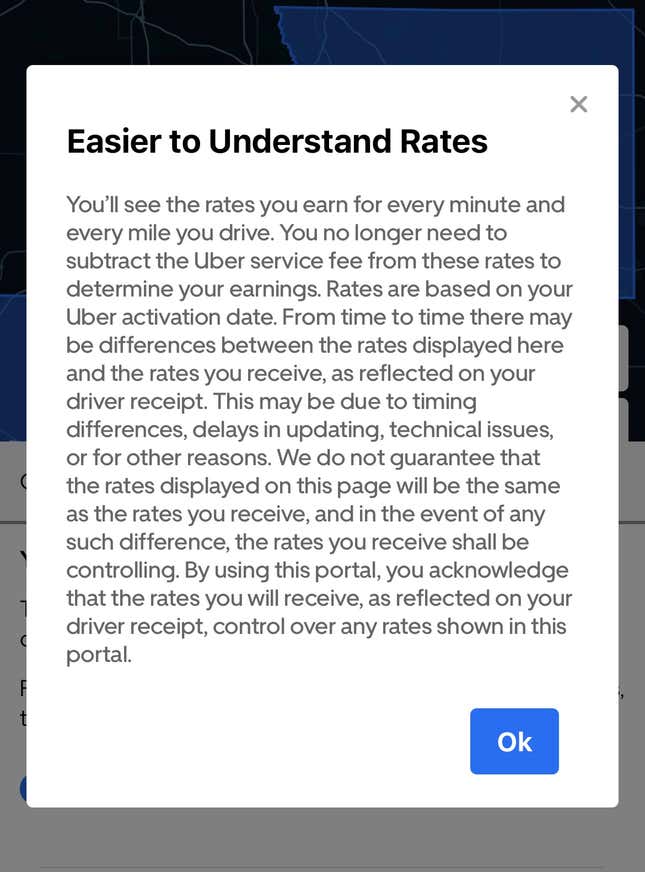

In fact, drivers are now paid on a per-mile, per-minute basis, and it varies from market to market. I’ve even had other drivers tell me they’ve seen rates vary from person to person. Passenger cost is completely disconnected from your driver’s wages.

This pay-scale started in 2016 when both Uber and Lyft launched upfront pricing, first in select markets and then nationwide by 2017. Uber and Lyft began calculating ride costs based upon whatever they think the rider would be willing to pay. With that change, the driver’s pay shifted from the percentage commission-based pay to the per-mile, per-minute rate.

I am paid $0.87 per mile and about $0.13 per minute to drive for both Lyft and Uber in the Columbus area. Different cities have different rates, Cleveland Ohio’s Lyft rate is $0.60 per mile. Keep in mind that the IRS’s reimbursement fee is only $0.58 per mile for 2019. ($0.575 for 2020)

Of course, both apps have surge pricing (“prime time” in Lyft speak). When I first started, there was a direct relationship between surge pricing and my driver wages. Now, it’s unclear if the elevated surge price is always passed onto the driver. Both companies have changed their surge pricing policies, to criticism from many. For example, Lyft still charges passengers “prime time” rates during periods of elevated demand, but that has completely been divorced from driver pay. Instead, they’ve replaced it with “Personal Power Zones.”

Because of the pandemic, I don’t feel comfortable shuttling around passengers. So, I have opted to stick to food deliveries via Uber Eats. The pay scale for that is different — it’s “Base fare + Trip Supplement + Promotions + Tips” according to the Uber website. However, the way the base fare or trip supplement is actually calculated is unclear. Mine seems to be somewhere in the realm of at least $2 per order.

This is all to say that a driver’s pay is pretty opaque, and concrete information is hard to find outside of places like Reddit or other Rideshare blogs.

I drive well above average mileage

When I bought my Sonic in 2016, it had 44,000 miles . As it stands today, I’m just shy of 206,000 miles. Between my regular driving and driving for Lyft and Uber, I’ve consistently been driving around 900 to 1,000 miles a week. Just last year, I set a new record, with over 50,000 miles driven between the two apps and my personal driving.

By comparison, the average American drives 13,500 miles, according to the Department of Transportation.

When the IRS’s $0.58 per mile reimbursement is applied, the year-end income numbers can be pretty devastating to ponder. As I said before, I was losing money driving for Lyft and Uber after taxes and expenses.

What are your maintenance and running costs actually like?

I’ve been running in circles making ends meet for a long while now. But because I drive so much, wear and tear are accelerated, so I often find myself doing repairs sooner than most. So buckle up, because the list is long.

Keep in mind these prices are only for parts unless otherwise indicated. I either do the work myself, or I have other car friends who are willing to help me at a greatly reduced cost.

About three tanks of gas per week. As I said earlier, I drive around 900-1000 miles per week, in mixed traffic. I spend around $90 per week, give or take.

Full synthetic oil changes, every six to eight weeks. I use only full-synthetic. I have a cam seal and a few other seals that are starting to sweat, and recently the car has started using about a quart of oil between changes. I’m not concerned, I don’t know any car with 200,000 miles that isn’t overusing some sort of fluid. I only spend around $20 for synthetic oil and new filter. I also replace the air filter every other oil change, at around $5 per filter.

Fourteen tires. Four of them I’ve lost to punctures or potholes. By the math, that means I get a little over a year out of each set of tires. That’s more tires than most people use, but most people aren’t driving at 3 a.m. with a car full of inebriated people, attempting to find addresses in unfamiliar neighborhoods, in the dark. Ohio’s roads are full of potholes. You hit some. I am averaging $127 per-tire, including puncture repairs, mounting and rebalancing fees.

Brake pads and rotors are done roughly once a year. I’ve done four brake jobs on the car , the most recent being about four months ago. I also admit that at times I’ve been cash strapped, so at least one of those brake jobs was done with low-quality pads and rotors. Parts for this run me about $130 on average, per brake job.

Rear drum brake shoes. There’s a commonly held opinion that drum brakes are outdated or bad, but in a small front-wheel-drive car, the front brakes do most of the work anyway. The fact I didn’t have to replace the rear shoes until nearly 200,000 miles is pretty damn impressive. The drums were fine, so only $37.22 for brake shoes.

Three lower control arms. The first lower control arm was a fluke and was done at around 115,000 miles. A visual inspection revealed that one of the bushings that held the lower control arm to the subframe had torn and nearly completely separated from the control arm itself. At the time, the ball joint on the control arm looked fine, but the ruined bushing was definitely a safety issue. Then, about 75,000 miles later, the ball joints on both sides had worn out, so I replaced both lower control arms. The Sonic’s ball joints are a fixed part of the lower control arm assembly, so replacement of just the ball joints alone is more trouble than it’s worth. This cost me about $669, including wheel alignment(s), and reduced cost labor from a friend.

All four struts and shocks, strut mounts, strut bellows. My rear tires had started to cup slightly, and I noticed that the ride on anything that wasn’t a glass-smooth road was absolute garbage. The car had just shy of 200,000 miles —the suspension simply had worn out. I drive hard, and I’ve carried thousands of passengers. That takes its toll. The total cost was $791.70, including reduced cost labor from a friend.

Tie-rod ends, inner and outer. At around 125,000 miles I heard some clicking and felt play, so I replaced both outer tie rods. But, not long after the suspension overhaul just shy of 200,000 miles, I figured it would be good practice to replace both inners and outers. I spent $111.86 for four outer tie rods, and two inner tie rods.

Front sway bar links, done at around 125,000 miles. My roommate argues that these are wear items, and he says he replaces the ones on his Scion xB about every year. They got me for $41.58 for two suspension endlinks.

A CV axle decided to start clicking at 165,000 miles. I spent $123.79 for an OEM brand CV axle, and $20 for a special socket to take the CV axle out.

A battery. The original lasted around seven years, which is about right for a typical car battery. Also, the alternator went kaput not long after the battery died. I opted for a used alternator out of a nearly new wrecked Sonic, instead of shelling out for a new or remanufactured one. I spent $110 on a brand new battery, and $65 for a used alternator.

At around 140,000 miles, I did a tune-up service where I serviced a couple of items. I replaced a noisy accessory belt tensioner, but I also replaced the spark plugs as well. Altogether, I spent about $75 for an accessory belt tensioner, accessory belt, and four spark plugs.

Other repairs that might be a bit more than maintenance?

Obviously wear is accelerated, because I’m driving so much. The chances of a “one-off” failure, or some sort of freak accident, are much higher than for most drivers.

For starters, I’ve replaced my windshield twice, due to flying debris and rocks from other drivers. I don’t have glass coverage in my insurance policy, so that was $300 each time, out of pocket.

Also, despite what the internet fanboys will tell you, every car on the market has its little nasty quirks, the Sonic included.

To start, at around 125,000 miles, I replaced a turbo boost sensor, for $41.

I’ve had a few coolant leak issues with the Sonic, that called for the replacement of the water pump inlet (thermostat), coolant reservoir, and a few assorted hoses and plastic junctions. Total cost for replacement parts was in the ballpark of around $110.

At around 175,000 miles, my brake master cylinder decided to fail. I had never changed the brake fluid, and the moisture that made its way into the brake system over time ruined the seals in the master cylinder. Like the alternator, I opted to replace it with a used unit from a low-mile wrecked Sonic, for $40.

The GM 1.4T, also known as the LUJ or LUV, engine is known for having a crappy PCV system. The fix is a replacement valve cover and intake manifold. These are well-known issues, but replacing the valve cover and intake manifold only took an hour and a half, so I wasn’t too upset. The repair cost around $200 in parts.

Last summer, at around 158,000 miles, the wiring to the knock sensor failed. Without a knock sensor, the car would run in a sort of “default” ultra-conservative tune, retarding timing as much as it could. GM sells a splice kit to fix that which cost me around $32.

At 201,000 miles, the plunger that operates the clutch master cylinder broke off in the clutch pedal itself. The fix was a new (used) pedal assembly. The pedal assembly could be removed only by taking the entire steering column out. The replacement cost $30 for the used pedal box, but $300 for labor.

Since I live in a Rust Belt state, I’ve had to pay for more than a few exhaust repairs. This happens roughly once a year or so, and usually costs me in the ballpark of $75.

Uh...are there any other costs we should know about?

Yes, there are. Rideshare is more than just regular driving, there are some other costs associated with what is essentially running a taxi business with your car.

This work is a sort of low-grade commercial driving, regular car insurance is inadequate. Lyft and Uber have some coverage, but it’s incomplete. It offers only bare-minimum liability insurance for the driver when they’re online, but without a ride request. (This is known as Period 1.) Also, many personal car insurance policies have clauses against policyholders’ driving for ride-hailing services without a specific endorsement. Thus, I had to purchase special insurance, which is more expensive than traditional car insurance.

Somewhat related to routine maintenance, I pay monthly for a subscription to a local automatic car wash chain. A clean exterior and interior encourage passengers to give good ratings and tip more generously. My subscription is $25 per month.

Lyft and Uber are location-based GPS services, so I carry an unlimited-everything cell phone plan. I also pay for Apple Music, as it helps keep me from getting bored during the day. Apple Music is $5 per month.

Also, don’t forget any sort of repair takes time. Even though I often did repairs myself, I usually did them on weekends. Pre pandemic, weekends were my biggest money-makers. Sometimes, repairs took multiple days or even weeks. While the car is down for repairs, that meant I was unable to earn a living with the vehicle until it was fixed.

Oh shit.

This is a lot to take in. Not including oil changes, I’ve spent at least $6,000 in repair costs, according to this article. In a vacuum, that isn’t so bad. But remember how I got there. I did it by doing my own maintenance, relying on friends, buying parts online, and being generally mechanically inclined. For someone who doesn’t have those skills or connections, it would be very easy to blow well past my comparatively low maintenance total.

For 2019, my gross income, pre-expense income for both apps was around $29,272. Using the IRS’s $0.58 per mile reimbursement fee, and writing off a portion of my cell phone bill, totals out to about $29,500. So, last year I technically paid about $250 to work.

By comparison, in 2018, I earned $22,729 in gross income via ridesharing. But, I had only driven 32,000 miles that year. In 2018, the IRS’s reimbursement rate was $0.545 per mile, putting me around $17,500 in expenses. Which meant my profit that year was a little over $5,000.

My car is now essentially worthless, but I knew that was a possibility as a full-time driver.

The thing is, a lot of aspiring Uber and Lyft drivers don’t always know that. Many do not make enough to outpace their car’s depreciation and maintenance costs. Many don’t count the costs of one-off repairs, or more expensive rideshare insurance, or even the costs associated with simply keeping your car clean. I have seen too many sad stories of drivers trying to make a living, but never getting in front of the negative equity on their car loan. Now, they’re completely upside down on a car that has no value, and they can’t pay down the balance on the loan or trade into something else. Or worse, the car has suffered a catastrophic failure that they can’t afford to fix.

Should I do it? Is it even worth it?

For many, driving for one of the ride-hailing services isn’t worth it. It’s very easy to run a car into the ground and still come out with no money, barely able to make ends meet. For others, doing a few hours a month or so for some extra cash will have a negligible effect on their car’s value or maintenance routine, so it makes sense for them. It’s easy to get seduced by the feeling of having instant cash in your hands, neglecting to do the math to see if the whole venture made any sense. For some, this is the only option they’ve got, and cash in hand is better than no cash at all.

Anyway, whatever you do, make sure you count the costs before you get out there.