The disparity in manufacturing wages between Mexico and China is starker than ever.

In China, where wages in the manufacturing sector have more than tripled in the past decade, the average factory worker in 2020 was paid about $6 an hour. Meanwhile, a factory worker in Mexico earned a little over $2 an hour—a number that has barely changed over the past 10 years, according to a recent report from Bank of America.

China’s wages have been rising as fewer people have entered the country’s labor market, which is one of the more noticeable effects of Beijing’s one-child policy. The policy was implemented in the late 1970s and lasted until 2016.

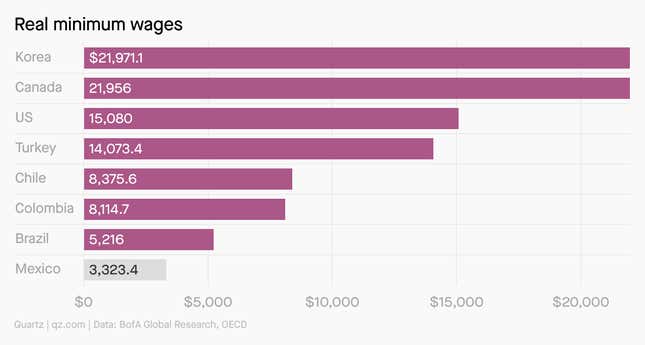

Mexico also continues to have one of the lowest minimum wages compared to other emerging markets. But productivity has not increased in recent years, the BofA researchers noted.

Low wages, in general, have long attracted businesses to open factories in Mexico, but the pandemic may have accelerated that as labor costs along the supply chain have increased in recent years.

The covid-19 pandemic has pushed businesses to diversify where they source

It isn’t just wages that are beckoning manufacturers to consider expanding in Mexico. The availability of qualified labor and geographic nearness to the US also help make the case for Mexico, as does the broader interest among companies, since the start of the covid-19 pandemic, in diversifying their sources in order to reduce supply chain risks.

Mexico’s manufacturing sector has increased more than 5% year-to-date in real terms, according to the BofA report. The researchers forecast that if Mexico capitalizes on the full potential for the relocation of supply chains, it could increase its exports by 30%, or about 9% of GDP, in the coming years.

Though Mexico stands to benefit from the supply chain fallout, the researchers note that it faces a slew of competitors including manufacturing bases in Taiwan, Korea, Malaysia, Indonesia, and India.